Tax exemption for IT employees [Infographic]

23 January 2018 / Written by PATRASCANU IULIAN / Print article

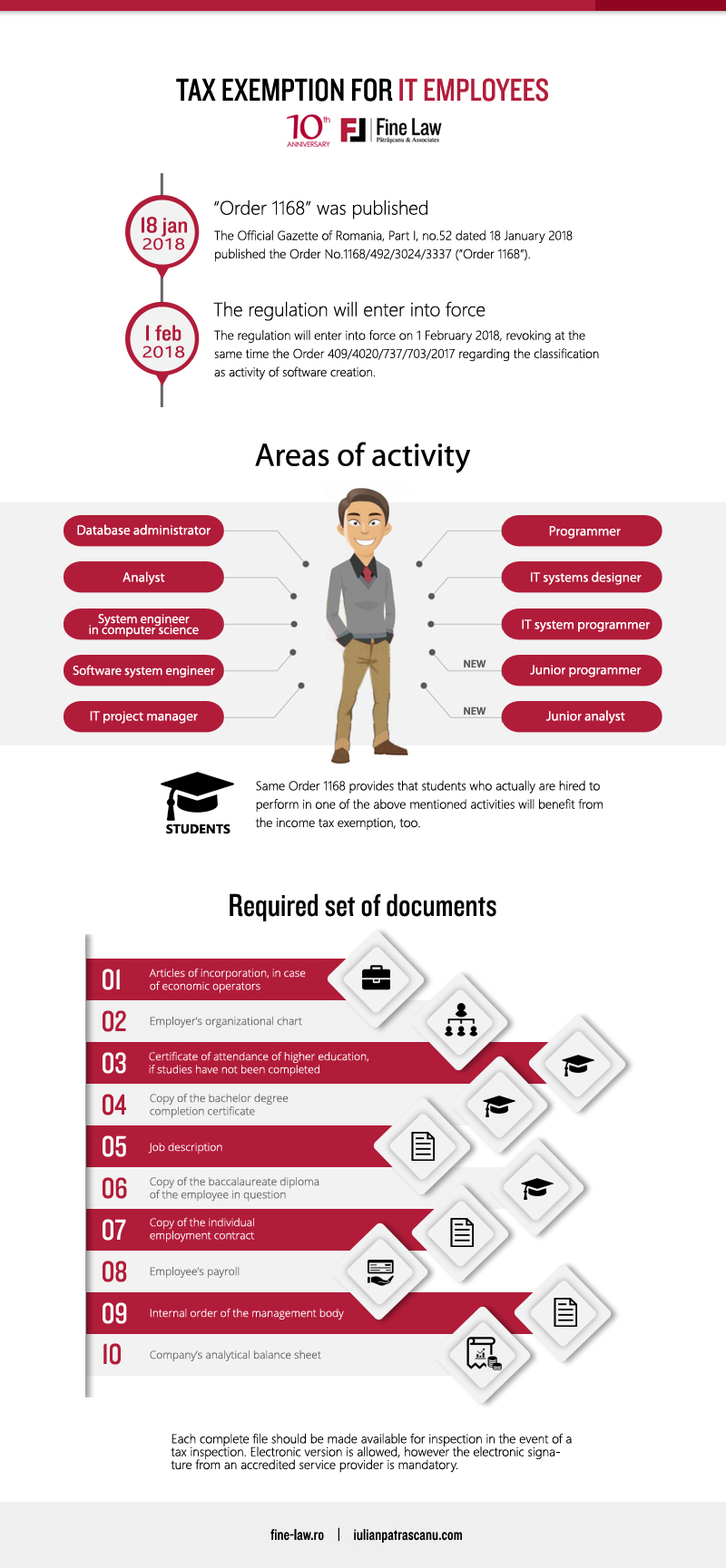

The Official Gazette of Romania, Part I, no.52 dated 18 January 2018 published the Order No.1168/492/3024/3337 (”Order 1168”).

The regulation will enter into force on 1 February 2018, revoking at the same time the Order 409/4020/737/703/2017 regarding the classification as activity of software creation.

Areas of activity

The Order 1168 introduces the tax exemption for salary income of employees in the following areas of activity:

- Database administrator

- Analyst

- System engineer in computer science

- Software system engineer

- IT project manager

- Programmer

- IT systems designer

- IT system programmer

- Junior programmer

- Junior analyst

As a novelty, it should be noted that Order 1168 provides for the addition of two job titles: junior programmer and junior analyst, which also benefit from tax exemption.

Furthermore, same Order 1168 provides that students who actually are hired to perform in one of the above mentioned activities will benefit from the income tax exemption, too.

The complete set of documents

In order to qualify for tax exemption, an employer should have a complete set of documents for each IT person, as indicated below:

- Articles of incorporation, in case of economic operators

- Employer’s organizational chart

- Job description

- Copy of the bachelor degree completion certificate

- Certificate of attendance of higher education, if studies have not been completed

- Copy of the baccalaureate diploma of the employee in question

- Copy of the individual employment contract

- Employee’s payroll

- Internal order of the management body

- Company’s analytical balance sheet

Each complete file should be made available for inspection in the event of a tax inspection. Electronic version is allowed, however the electronic signature from an accredited service provider is mandatory.

Share this article on